This article is my second about the yield market, following my recent experiences and insights from the 34th Annual High Yield Conference.

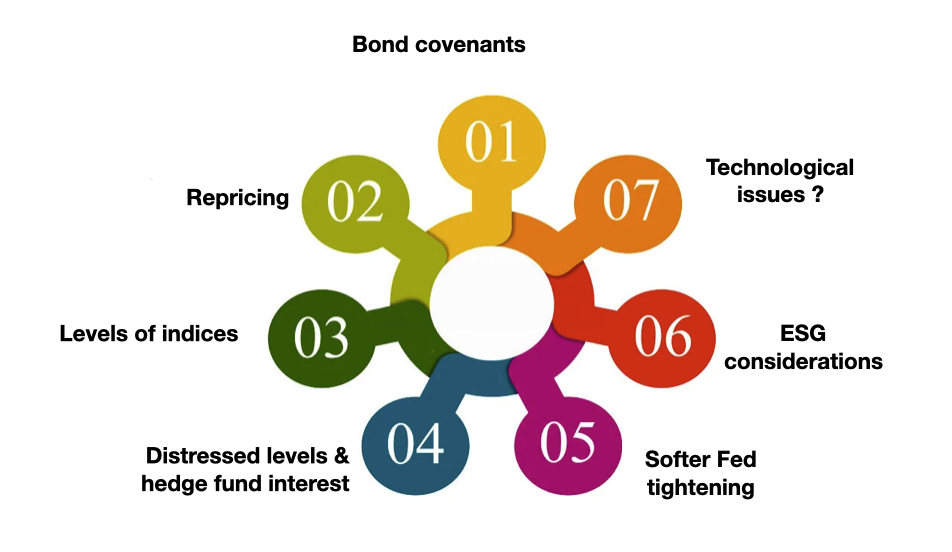

It delves into several key trends discussed in the conference, such as the implications of looser documentation, increased basket capacity, and flexible terms for issuers and investors. The necessity of repricing in response to market changes was discussed as well as the role of high-yield bond indices in investment strategies, the significance of distressed levels in evaluating risk, the impact of softer Federal Reserve tightening on borrowing costs, the growing importance of ESG considerations in investment decisions, and the innovative application of AI in credit risk measurement.

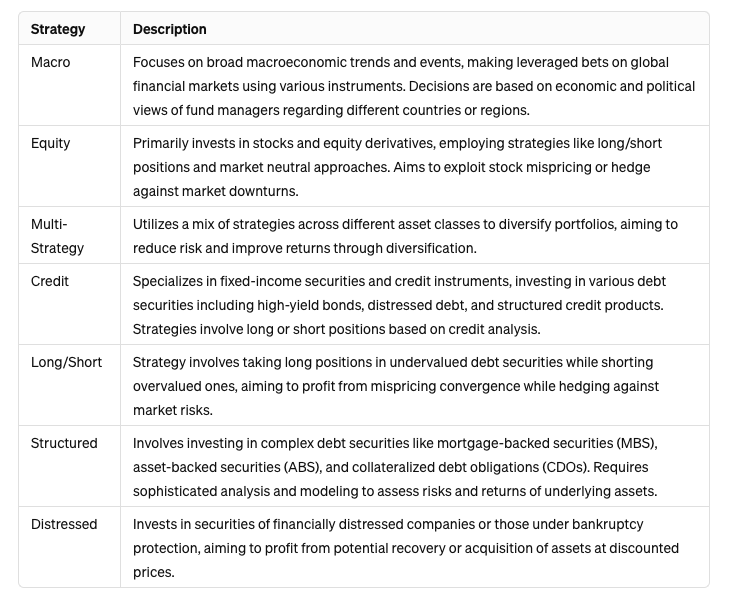

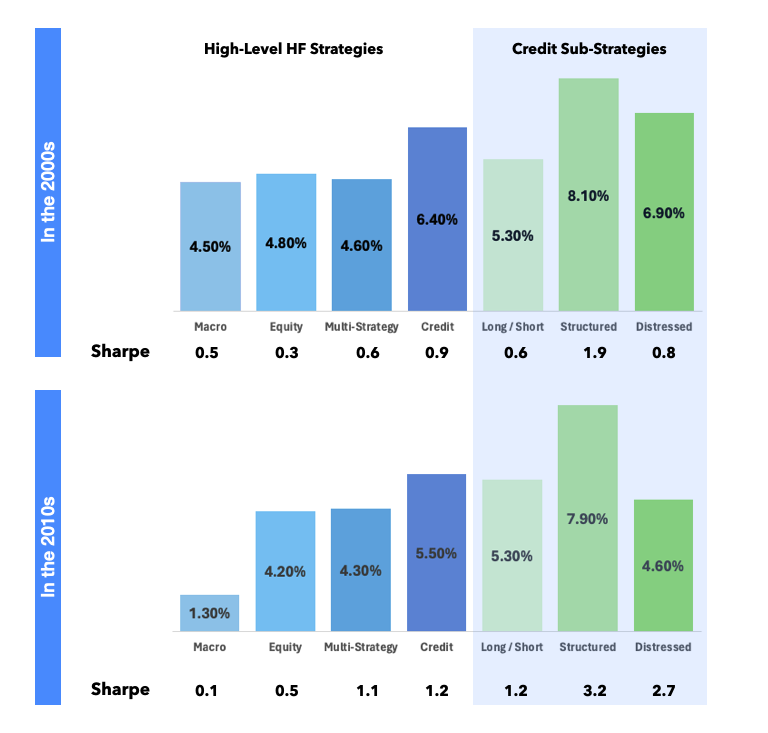

I am very excited about these recent developments since they support my view about where the opportunities are in the next 2-5 years. Before the main points, as a refresher or for those not familiar with the general classification of hedge funds, here is a table:

This article delves into several key trends discussed in the conference:

Looser Documentation, Increased Basket Capacity, and Flexible Terms

Looser documentation in the context of high-yield bonds refers to the trend of bond covenants becoming less stringent, which can lead to more borrower-friendly terms. This often includes a broader set of 'permitted liens' and 'permitted investments,' allowing issuers more flexibility in how they manage their assets and liabilities.

Increased basket capacity relates to the negotiated carve-outs within the bond covenants that permit the issuer to incur additional debt or make investments that would otherwise be restricted. These baskets are tailored to the issuer's needs and strategic business plan, providing them with more room to maneuver financially without breaching covenant terms Flexible terms may also include features like portability, which allows a bond to be transferred in a change of control situation without triggering a put option, or looser maintenance covenants, which are financial ratios the issuer must maintain to avoid default.

Repricing in the high-yield market occurs when there is a reassessment of the value of an investment due to changes in the market environment, such as interest rate fluctuations or changes in the issuer's creditworthiness. It is necessary when the market conditions have shifted in such a way that the current interest rates on existing debt are no longer aligned with the market. For example, if average clearing spreads for new issues decrease, issuers may seek to reprice their existing debt to lower their borrowing costs, taking advantage of the narrower spread between the new issue rates and the rates on their outstanding debt.

A high-yield bond index measures the performance of a basket of high-yielding corporate bonds, reflecting the market-value-weighted performance of these securities. Indices like the S&P U.S. High Yield Corporate Bond Index are rebalanced monthly and provide a benchmark for the high-yield bond market.

Investors cannot directly buy an index, but they can invest in index funds or exchange-traded funds (ETFs) that aim to replicate the performance of a high-yield bond index. These funds can be purchased through brokerage accounts, and the minimum investment will depend on the specific fund's requirements.

Distressed levels refer to the trading status of securities issued by a company that is near or going through bankruptcy, or that has breached certain covenants. These securities are considered distressed because the issuer is struggling to meet its financial obligations, leading to a substantial reduction in the value of its financial instruments. Distressed securities are high-risk but can offer the potential for high returns to investors willing to accept that risk.

Investing in distressed debt is a specialized area that requires a deep understanding of the risks and potential rewards associated with companies facing financial difficulties Thus some large players might have a tremendous impact in the risk/return profile of selected opportunites. Some prominent hedge funds that are known for their activities in this area include:

Softer Fed tightening implies a more gradual or less aggressive approach by the Federal Reserve to increase interest rates. This can occur when the Fed aims to slow down inflation without significantly hampering economic growth. Softer tightening may lead to a more stable or favorable borrowing environment, as drastic increases in interest rates can lead to higher borrowing costs and potentially slow down economic activity.

Environmental, Social, and Governance (ESG) considerations refer to the three central factors in measuring the sustainability and ethical impact of an investment in a company. ESG factors include how a company performs as a steward of the natural environment, how it manages relationships with employees, suppliers, customers, and the communities where it operates, and a company's leadership, executive pay, audits, internal controls, and shareholder rights. High ESG standards are increasingly seen as indicators of a company's long-term viability and creditworthiness, as they can impact a company's reputation, legal risks, and operational performance.

AI and machine learning are increasingly being used in credit risk measurement to enhance the accuracy and efficiency of credit analysis. These tools can process vast amounts of data, including non-traditional data sources, to identify patterns that may not be evident to human analysts and predict rating transitions.

AI driven models could predict outcomes, assess credit risk, and monitor sentiment shifts in real-time, enabling proactive portfolio management and quicker decision-making. Financial institutions, credit rating agencies, and fintech companies are among those leveraging AI for credit risk analysis, using these technologies to automate data collection, perform deep data analysis, and generate predictive insights into borrower behavior and market trends.